-

Improve Employee Experience (EX) by eliminating commodity-level tasks

-

Save staff time and reduce operation costs by 10%

-

Eliminate rework with improved data accuracy

-

Eliminate staffing swings associated with market shifts

The Smart Choice for Modern Mortgage Lending

Book a Meeting

Pick a date that works to see available times to meet one of our sales representatives.

Modernize Appraisal Reviews

Value Connect is an intelligent appraisal technology platform that provides a comprehensive suite of solutions to help lenders optimize the appraisal process, increase customer satisfaction, and reduce operational costs. Our empowering, cutting-edge technology has revolutionized traditional processes and proven to be an effective tool for lenders looking to improve their market share and funding ratios.

By leveraging our intelligent platform, lenders increase their market share and funding ratios by improving customer and employee satisfaction. Our platform enables lenders to eliminate commodity-level tasks, such as basic quality control checks and manual data entry, freeing up valuable time for employees to focus on higher-level tasks. This improved employee experience leads to increased job satisfaction and employee retention rates.

How does Value Connect’s app benefit you?

Reduce appraisal review by 65%

Reduce operational costs 10% by eliminating 65% of the commodity-level appraisal review quality control checks.

Eliminate rework & data entry

Our platform strips out manual data entry, rework, and re-entry. This leads to faster turnaround and lending decisions.

Enhanced analytics & reporting

Get real-time access to your data for enhanced analytics and reporting to regulators and investors.

Improve EX and Reduce Costs

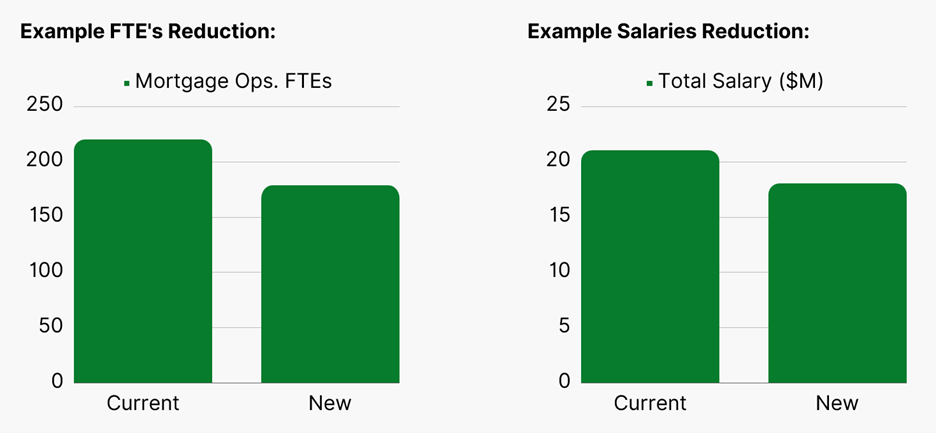

By reducing appraisal review time by 65% and eliminating duplicate entry, our platform helps lenders reduce operational costs by up to 10%. We achieve this by automating steps in the appraisal process, eliminating manual data entry and quality control checks, and improving data accuracy. Our platform also helps to eliminate staffing swings associated with market shifts, providing lenders with greater flexibility and agility.

Streamline Your Appraisal Process

Value Connect's platform integrates with the software used by everyone in the mortgage loan and appraisal process, allowing for end-to-end bi-directional communication and real-time status updates. All data is encrypted at rest and our process exceeds PIPEDA requirements, ensuring the security and privacy of sensitive information.

Our intelligent appraisal technology embeds your property guidelines and appraisal terms of reference throughout the process, providing a range of benefits for lenders, including:

- Minimizing appraisal review time by 65% and increasing throughput by 200%

- Streamlining the appraisal process and improving efficiency

- Improving data accuracy and reliability

- Reducing the risk of inaccurate property valuations

- Ensuring impartial appraisals through expert management

At Value Connect, our industry-leading technology amplifies the effectiveness and accuracy of digital operations, streamlining processes and fostering operational efficiency. By automating data transfers and quality control checks, we are able to reduce wasted staff time and improve the accuracy and reliability of data processing. Our platform provides lenders with the latest technology to make their workflow easier and more efficient, allowing them to stay ahead of the competition and deliver better results for their customers.

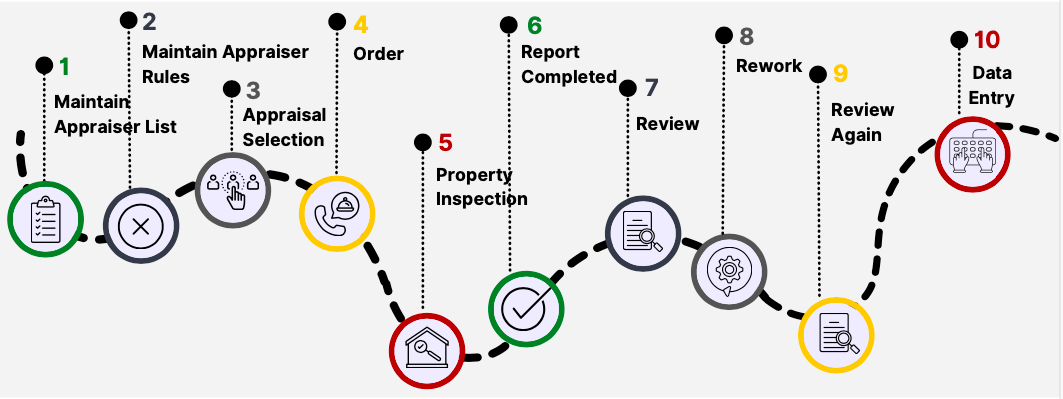

The traditional appraisal process:

The Value Connect appraisal process:

Transform Your Mortgage Business with Value Connect's Innovative Platform

With our platform, a mortgage team of 50 can save $500,000 in costs and eliminate 16,500 hours of inefficiencies.

.png)

Value Connect offers an empowering and intelligent appraisal mortgage platform that streamlines processes and increases efficiency. By automating commodity-level tasks and embedding quality control throughout the appraisal process, we can help lenders to significantly reduce operational costs.

We're proud to have been approved by some of Canada’s largest lenders, including MCAP, First National, and the Government of Canada. Our platform is easy to adopt and staff can use systems they’re already familiar with, making it an employee-friendly option. The customer experience is also enhanced, with Google Reviews up to 3.8x better than the competition. Our platform speaks to our speed, accuracy, and consistency.

With our platform, lenders can change appraisals to a profit center by leveraging digitized information from reports. Our system offers 99.9999% uptime, ensuring reliable and uninterrupted service. Overall, Value Connect's technology is designed to help lenders stay ahead of the competition, streamline processes, and deliver better results for their customers.

Pricing

Looking for an alternative to your current Appraisal Management Company?

Start here, then move to our Smart Appraisal

Analytics Platform™ for a 10X ROI.

Appraisal

Management

Services (AMS)

No monthly fee

Cost + appraisal fee pricing

Features included

-

Fee Guarantee

-

Appraiser list management

-

Unlimited Users

-

Industry leading support

-

AVMs

-

Tiered volume discounts

-

No mileage charges for “in-city” reports

Save 65% of staff’s time on appraisals. Increase throughput by 200%.

Not convinced? Get on the platform at 75% off and let us prove we can deliver.

Analytics

Platform

(Requires AMS)

Monthly Subscription + per report fee to scrub and data transfer + appraisal report fee

Features included

-

Quality controlled appraisal

-

Report data integration

-

Industry leading support

-

AVMs

-

Unlimited Users

-

Appraiser list management

-

Embedded Risk Rules

Reviews from our Underwriters

Get inspired by these reviews.

The team at Value Connect stands by their name; they do bring us Value. For example, I had a tight deadline to meet, and they came through for me and, most importantly, our mutual clients. Value Connect is my go-to connection to Appraisers.

Patrick

Underwriter

We have been using Value Connect for almost a year now and the service has been amazing. The constant follow-up and the urgency they put on each order is exceptional. We are so happy to see more team members are using their service.

Rania

Underwriter

I have worked with Value Connect since they started. The team is a pleasure to deal with and respond to questions quickly. I look forward to working with Value Connect and would recommend them to anyone in the mortgage/lending industry.

Drew

Underwriter

Be an industry leader.

It’s time to try Value Connect.

Reduce costs by 65%, eliminate rework, and increase appraisal throughput by 200%

Book a Meeting

Pick a date that works to see available times to schedule a demo.